×

![Team member photo]()

Team Member

Position

Approach the market with confidence

By partnering with our senior investment banking team that combines deep industry expertise with proprietary technology to best serve our clients' capital raising and M&A needs

We specialize in structuring tax-equity and debt transactions across utility-scale, community, commercial, and residential renewable energy projects.

Development Capital

Sponsor & Tax Equity

Project Debt

We conduct professional M&A sell-side and buy-side processes around renewable energy projects and portfolios.

Sell-Side

Buy-Side

Expansive Acquirer Network

Our team assists companies participating in leading-edge clean energy markets with structuring and strategic guidance.

Outsourced Project Finance

Financial Analysis & Modeling

Strategic Consulting

NextPower Capital is a specialized clean energy investment bank that operates across the United States. Unlike traditional firms, we operate with a unique model: senior investment bankers lead every transaction from beginning to end, supported by our proprietary technology platform rather than junior associates.

Our team has worked with many of the top developers and investors in renewable energy across over 50 client engagements. With decades of hands-on experience in project development and capital formation, we function as a seamless extension of your team rather than just an external advisor.

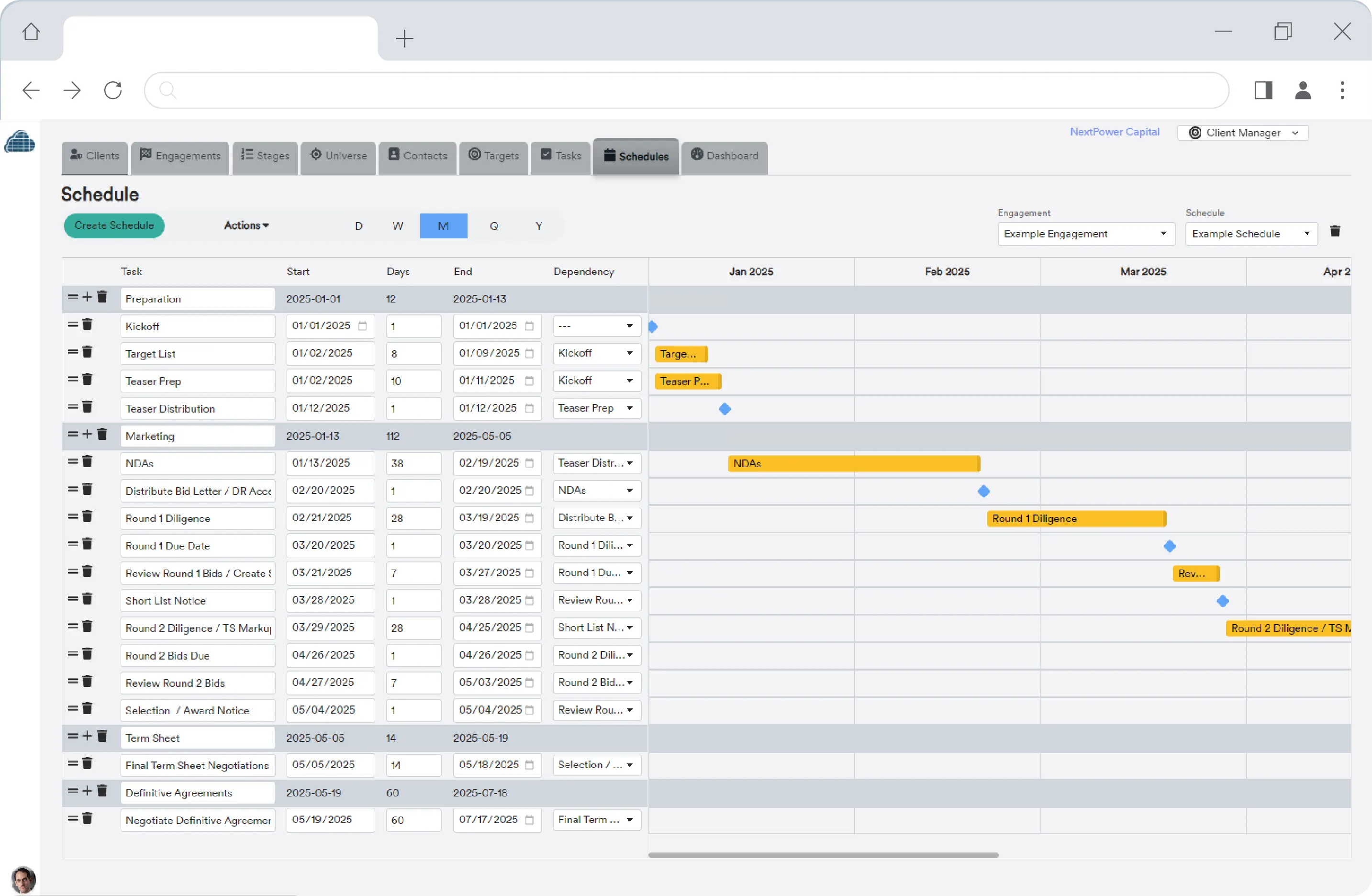

Our core team includes seasoned investment bankers with deep sector expertise, supported by dedicated financial analysts and software engineers who continuously enhance our proprietary iBankSuite platform. This technology-enabled approach helps deliver superior outcomes, greater transparency, and exceptional value to our clients across capital raises, M&A transactions, and strategic advisory services.

Founded

Client Engagements

Years of Renewable Financing Experience

Person Dedicated Team

Managing Partner

Mr. Goldman has worked in the renewable energy finance industry since 2004 and has led and closed hundreds of transactions, as well as successfully launching several entrepreneurial ventures.

Managing Director

Mr. Magner has led $13+ billion in financings for wind, solar and storage projects over his 18 year carreer in the renewable energy sector.

| When NextPower Capital is the Right Fit | ||||

|---|---|---|---|---|

| When to choose... |

|

In-House

Team |

Other Boutique

Investment Banks |

|

| Best solution when... | You need specialized expertise with minimal overhead and maximum senior attention | You have consistent deal flow and can justify full-time specialized personnel | You require the services of a large team to run a process | |

| Internal bandwidth is limited | Managing directors lead nearly every aspect of deal | Internal resources are limited | Hiring a large team is often over-kill to free up internal resources | |

| Deal size sweet spot | $5M to $500M+ with full attention at all sizes | Highly variable based on internal resources | $50M to $1B, where a team can be tasked | |

| When speed matters | ✓ Nimble team with technology advantages | ✗ Often slowed by competing priorities and internal obligations | ◑ Depends on current workload and competing deals in same market | |

| Tax equity is involved | ✓ Extensive network and industry-leading expertise | ✗ Limited Tax Equity relationships and knowledge of market terms | ◑ Most advisors are just focused on M&A | |

| First-time / complex deals |

✓ Hands-on guidance from senior experts | ✗ Steep learning curve and execution risk | ◑ Varies based on specific expertise | |

| Cost efficiency | ✓ Technology-enabled with limited junior staff overhead | ✗ Hidden costs of full-time personnel | ◑ You will pay significantly for mostly junior support staff | |

| Deal transparency | ✓ Highly transparent process wtih real-time visibility via iBankSuite | ✓ Full internal visibility | ◑ Traditional updates only | |

| Senior-level attention | ✓ Managing Directors lead every aspect and are available any time | ◑ Depends on internal structure | ◑ Junior staff handle much of the work | |

iBankSuite is our proprietary AI-driven investment banking platform available for free to our valued clients and close partners. With iBankSuite, we can more effective collaborate with our clients on engagments and set them up for success when our work is complete.

Experience the difference of partnering with industry veterans backed by proprietary technology

Tell us about your project or financing needs. The managing partner will respond personally within 24 hours if your project is qualified.

NextPower Capital combines deep sector expertise, senior-level attention, and AI-powered tools to deliver exceptional outcomes for renewable energy clients.

San Francisco Bay Area

Southern California